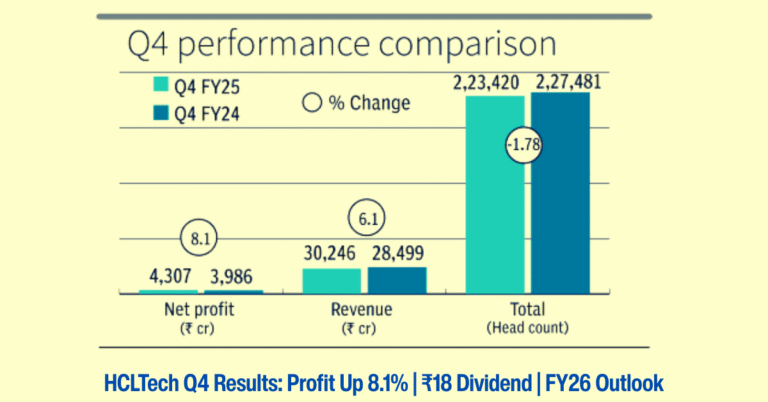

When you hear that HCL Technologies has just reported its Q4 results, you might think, “OK, another numbers game.” But stay with me: there’s a lot more to unpack than just a few rupees here and there. From net-profit growth to headcount changes, from dividend announcements to real-world guidance on what “2–5% growth in constant currency” actually means—this quarter tells a story about resilience, opportunity, and why many traders keep a close eye on the HCL share price and HCL tech share price after every earnings release.

A Snapshot of the Headlines

Let’s kick off with the big numbers:

-

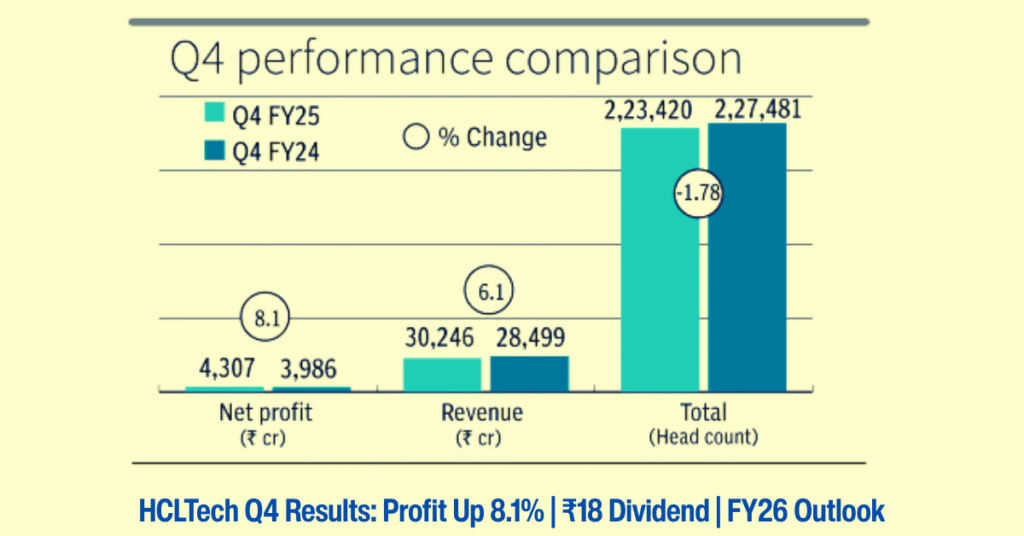

Net profit for Q4 ended March 31, 2025 jumped 8.1% year-on-year to ₹4,307 crore, up from ₹3,986 crore in Q4 FY24.

-

Revenue from operations rose 6.1% y-o-y to ₹30,246 crore, up from ₹28,499 crore in Q4 FY24.

-

On a full-year basis (FY25 vs. FY24), net profit climbed 11% to ₹17,390 crore, while revenue grew 6.5% to ₹1,17,055 crore.

-

Headcount stood at 2,23,420, down from 2,27,481 a year ago.

-

The Board declared an interim dividend of ₹18 per equity share (₹2 face-value).

-

HCL Tech share price on the BSE closed at ₹1,480.10 on the day of the results, essentially flat from the previous close.

That’s the factual skeleton. But numbers alone don’t tell you why HCL Technologies earnings matter—especially when global economic headwinds are swirling.

Why That 8.1% Net-Profit Jump Matters

An 8.1% rise in net profit might sound modest compared with some high-flying tech names, but context is everything:

-

Global macro challenges—from geopolitical tensions to rising tariffs—are squeezing margins across IT services.

-

Yet, even with those pressures, HCLTech beat its own guidance and outpaced most peers.

Think about it: every extra percentage point of profit in an industry facing headwinds is a vote of confidence in the company’s business model, cost controls, and ability to win new deals. For anyone tracking HCL Technologies Q4 results today, that uptick sends a clear signal—management navigated a tricky quarter well.

Revenue Growth: The 6.1% Story

Revenue growing 6.1% y-o-y to ₹30,246 crore shows the company isn’t just protecting margins—it’s winning business. Here’s why that number matters:

-

Steady Deal Wins

-

HCLTech reported $3 billion in new bookings this quarter, fueled by AI-focused propositions and a revamped go-to-market setup.

-

-

Services vs. Software

-

Its traditional services business grew 0.7% quarter-on-quarter (constant currency), while HCL Software grew 3.5% CC for the full year.

-

In simple terms: the old bread-and-butter IT outsourcing is holding steady, while software and AI-related offerings are picking up steam. That dual engine helps protect overall growth and keeps the HCL tech share attractive to investors seeking a balanced play.

Looking Ahead: 2–5% Growth in Constant Currency

One of the juiciest tidbits from management’s outlook: HCLTech expects 2–5% growth in constant currency (CC) for FY26. If you’re wondering what that really means:

-

Constant currency strips out the effect of rupee fluctuations.

-

So, even if INR moves against the dollar, HCLTech’s guidance is on the underlying global volume of business.

-

A 2–5% CC growth range signals cautious optimism—better than many peers, but not so aggressive that they risk missing it.

For anyone watching the hcl tech q4 results today, this guidance is your North Star. It tells you management sees more wins ahead, even if the macro environment stays choppy.

The Geopolitical Angle: Tariffs and De-Globalisation

CEO & MD C Vijayakumar didn’t hide from the challenges:

“Geopolitical factors like tariff and de-globalisation are expected to impact IT services. In the coming months, it will be an important topic to observe and monitor the ongoing development.”

In simple language:

-

Tariff pressures could make on-shore work more expensive or complicated.

-

De-globalisation trends could push clients to localise some services.

Yet, Vijayakumar also pointed to strong growth opportunities emerging from market uncertainties—think AI, digital transformation, cybersecurity. Companies will need help navigating new tech and regulations, and that’s where HCLTech’s integrated services can shine.

Diving Deeper: Services vs. Software

Let’s break down the two main arms of HCLTech’s business:

-

Services

-

Traditional IT outsourcing: application development, maintenance, infrastructure management.

-

Q4 services growth was 0.7% q-o-q CC.

-

Stable, low-margin but high-visibility revenue.

-

-

Software

-

HCL Software includes products bought/licensed, such as middleware, digital solutions, and now more AI-enabled tools.

-

Year-on-year CC growth of 3.5% in FY25.

-

Higher margins and more scalability.

-

Why does this matter? The services side offers predictability, while the software side provides higher-growth, higher-margin upside. For investors tracking hcl technologies earnings, the blend reduces volatility.

The $3 Billion in New Bookings

Every quarter, new bookings tell you how the pipeline is filling up:

-

AI propositions powered many of those wins—clients want help building, training, and deploying AI models.

-

An integrated go-to-market (GTM) setup, launched at the start of FY25, helped cross-sell services and software.

Three billion dollars in a single quarter is no small feat. It means HCLTech’s sales engine is firing on all cylinders, and they’re getting paid upfront or under long-term contracts—fuel for steady earnings.

Full-Year FY25 in Review

So far we’ve focused on Q4, but it’s worth stepping back to see the full picture:

-

FY25 net profit: ₹17,390 crore, up 11% from FY24’s ₹15,702 crore.

-

FY25 revenue: ₹1,17,055 crore, up 6.5% from ₹1,09,913 crore.

-

EBIT margin: 18.3% (in line with FY25 guidance).

That annual performance confirms this wasn’t just a one-quarter fluke. Growth and profitability held up throughout the year, even as costs crept up in some areas.

Headcount Dynamics: Slight Reduction, Big Signals

HCLTech’s total employee count dropped to 2,23,420 from 2,27,481 a year ago. Why trim headcount?

-

Automation and AI are helping deliver more with fewer hands.

-

Lean operations boost margins.

-

It may reflect a shift toward higher-value roles (AI architects, data scientists) instead of large offshore development armies.

A slight headcount reduction can spook some investors worried about layoffs. But in HCLTech’s case, it speaks to evolving business priorities—toward digital, cloud, and AI.

Dividend Delight: ₹18 Interim Payout

The Board approved an interim dividend of ₹18 per share (face-value ₹2). A few things to note:

-

That’s a 9× face-value payout—quite generous.

-

It shows confidence in cash flows and management’s commitment to returning capital.

-

For income-seeking investors, a high dividend yield can be attractive even if hcl share price doesn’t move much in the short term.

Dividends alone won’t make your portfolio, but when combined with growth and margin stability, they add to the total return story.

How the Market Reacted: HCLTech Share Price

On the day of the results, HCLTech share price on the BSE closed at ₹1,480.10, essentially flat. Why no big pop or drop?

-

Mixed signals: strong profit, but cautious guidance.

-

Macro uncertainties: investors remain wary of global headwinds.

-

Relative valuation: at current levels, HCLTech trades at a premium to some peers, so even good news may be “priced in.”

If you’re watching hcl tech share, patience may be key. Earnings seasons are more about reaffirming guidance than delivering shock-and-awe surprises.

Putting It All Together: Should You Care?

If you’re an end-user of HCLTech services—good news: they’re stable and innovating in AI.

If you’re an investor—here’s the snapshot:

-

Growth: mid-single digits in revenue, double digits in net profit.

-

Margins: solid 18%+ EBIT.

-

Cash flow: strong enough to support an ₹18 interim dividend.

-

Pipeline: $3 billion of new bookings.

-

Headcount: optimized but still large enough to deliver on big deals.

-

Guidance: 2–5% CC growth for FY26—cautious but above peers.

That balanced mix makes HCLTech a compelling “core” holding for those who believe in the long-term trajectory of IT services, especially around AI and digital transformation.

Risks to Watch

No analysis is complete without the caveats:

-

Currency swings: since guidance is in constant currency, a sudden rupee depreciation or appreciation could skew reported numbers.

-

Tariff hikes & localization: if major markets impose new rules, it could reshape service delivery models.

-

Competition: rivals like TCS, Infosys, and Accenture are also ramping up AI offerings. Win rates may squeeze.

-

Tech shifts: “platform consolidation” or moves toward in-house IT could hurt long-term deal flow.

Always weigh these against the growth story before making any call on hcl technologies q4 results today.

The Road Ahead: FY26 and Beyond

With global tech budgets expected to rise modestly, focus areas likely include:

-

AI and automation: building, integrating, and maintaining AI systems.

-

Cloud services: migration, management, and optimization.

-

Cybersecurity: a growing pain point post-pandemic.

-

Industry-specific solutions: healthcare, manufacturing, BFSI (banking).

HCLTech’s strong bookings this quarter suggest they’re already winning in these spaces. If they can deliver on that 2–5% CC growth—and maybe even beat it—then the HCL Technologies earnings story stays on track.

Final Thoughts

Turning raw numbers into real insights isn’t just about math—it’s about understanding strategy, execution, and the human side of business. HCLTech’s Q4 results show a company that’s steadying the ship in turbulent seas, while laying the groundwork for future growth in AI and digital services.

So next time someone asks, “What’s up with HCL Technologies?” you’ll know: healthy profit growth, stable revenues, smart investments in AI, and a dividend that says, “We’re confident in our cash flow.” That’s why traders and long-term investors alike keep tabs on the HCL share price and HCL tech share price every time the company announces its Q4 results.

Here’s to watching the journey—because in the world of IT services, the next big twist could be just around the corner.