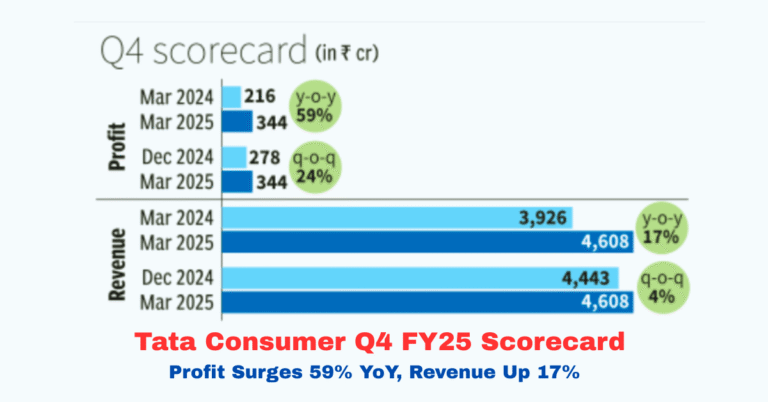

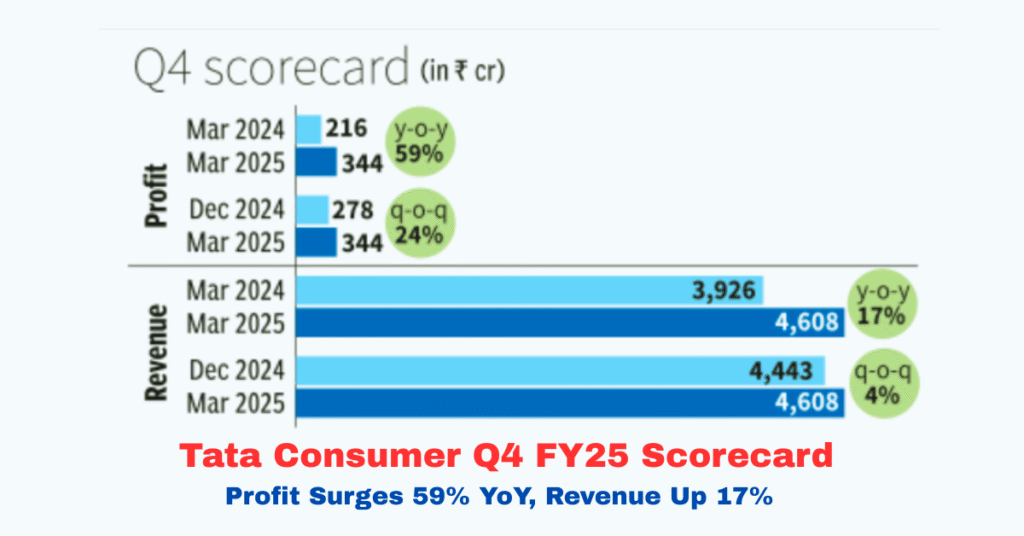

Tata Consumer Products (NSE: TATACONSUM) has recently announced its financial results for the fourth quarter ending March 31, 2025, showcasing a significant 59% year-on-year increase in consolidated net profit, reaching ₹345 crore. This impressive growth is attributed to exceptional gains and robust performance across various business segments. However, the company’s EBITDA experienced a slight decline of 1% due to increased input costs, particularly in the tea segment. Tata Consumer

Key Financial Highlights

-

Revenue Growth: The company’s revenue for Q4 FY25 stood at ₹4,608 crore, marking a 17% increase compared to ₹3,927 crore in Q4 FY24. Zee Business

-

EBITDA and Margins: Despite the revenue growth, EBITDA declined by 1%, with the EBITDA margin for the year at 14.2%, down 110 basis points. This was primarily due to tea cost inflation in India.

-

Dividend Announcement: The company declared a dividend of ₹8.25 per share for the fiscal year. Tata Consumer

Segment Performance

Domestic Business

-

Beverages: The beverages category witnessed a robust growth of 17.37%.

-

E-commerce and Modern Trade: E-commerce sales grew by 66%, while modern trade recorded a 26% increase. Tata Consumer

-

Product Innovation: Tata Consumer launched 41 new products during the year, with an innovation-to-sales ratio of 5.2% in India.

International Business

-

Revenue Growth: The international business registered a 2% revenue growth. Tata Consumer

-

Margin Improvement: Profitability in the international segment improved significantly, with all geographies demonstrating growth.

Non-Branded Business

-

Revenue Growth: The non-branded business saw a 23% increase in revenue.

-

Acquisitions: Capital Foods and Organic India, acquired by Tata Consumer, registered a combined revenue growth of 19%, totaling ₹1,173 crore for the year.

Strategic Initiatives

-

Go-to-Market Platform: The company completed the rollout of a next-generation Go-to-Market platform in India, strengthening its sales and distribution infrastructure.

-

Tata Starbucks Expansion: Tata Starbucks added six new stores during the quarter, entering six new cities, bringing the total number of stores to 479 across 80 cities.

Management Commentary

Sunil D’Souza, Managing Director & CEO of Tata Consumer Products, stated:

“We delivered a topline growth of 17% during the quarter, bringing FY25 growth to 16%. While the RTD business was impacted earlier in the year, we have seen a strong rebound as we exit the year. We delivered a strong performance in the International Business, with all our geographies demonstrating growth. In India, we continued strengthening our Sales & Distribution infrastructure and completed the rollout of a next-gen Go-to-Market platform. Overall, despite a tough operating environment, we delivered strong growth across businesses, and we will continue to drive consistent, profitable growth as we move forward.”

Tea Prices and Cost Management

The company undertook price increases during the full year and anticipates tea prices to soften. D’Souza mentioned:

“We have passed on 29% of the tea costs for the full year. We absorbed 54% of the costs…”.

Tata Consumer Share Price Analysis

As of April 24, 2025, Tata Consumer’s share price is trading at ₹1,124.3, reflecting investor confidence following the strong Q4 results. The company’s market capitalization stands at ₹1,13,802.23 crore, with a price-to-earnings ratio of 89.01 and earnings per share of ₹12.92. The Economic Times

Analyst Recommendations

Nuvama Institutional Equities has raised its target price for Tata Consumer shares to ₹1,335, citing the company’s robust Q4 performance and positive outlook. Zee Business

Technical Indicators

Technical analysis indicates a bullish trend for Tata Consumer shares. The stock is trading above key simple moving averages (SMAs), and the relative strength index (RSI) suggests rising strength. Analysts recommend buying, holding, and accumulating the stock, with expected upside targets ranging between ₹1,185 and ₹1,225, and support levels at ₹1,050–₹1,013.

Conclusion

Tata Consumer Products has demonstrated resilience and strategic agility in navigating a challenging operating environment. The company’s strong Q4 performance, driven by exceptional gains, robust domestic and international business growth, and strategic initiatives, positions it well for sustained growth. The positive analyst outlook and bullish technical indicators further reinforce the potential for Tata Consumer’s share price appreciation.

Investors looking for exposure to the FMCG sector may find Tata Consumer Products an attractive option, given its strong brand portfolio, strategic initiatives, and consistent financial performance.

*Disclaimer: This article is for informational purposes only

YOU MAY ALSO LIKE :

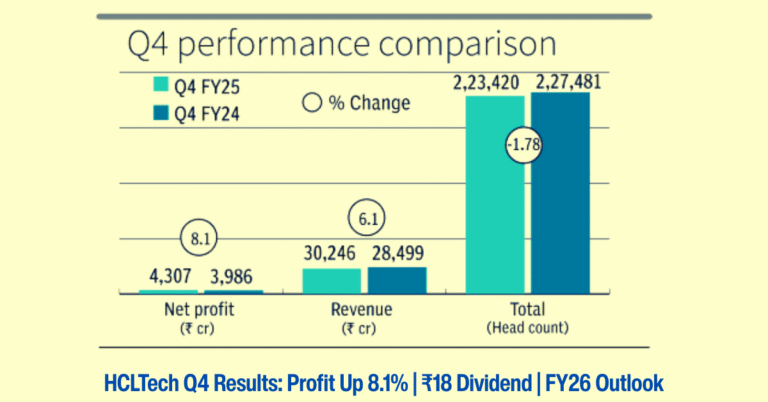

HCL Technologies Q4 Results Today: Net Profit Rises 8.1%, ₹18 Dividend, FY26 Growth Outlook